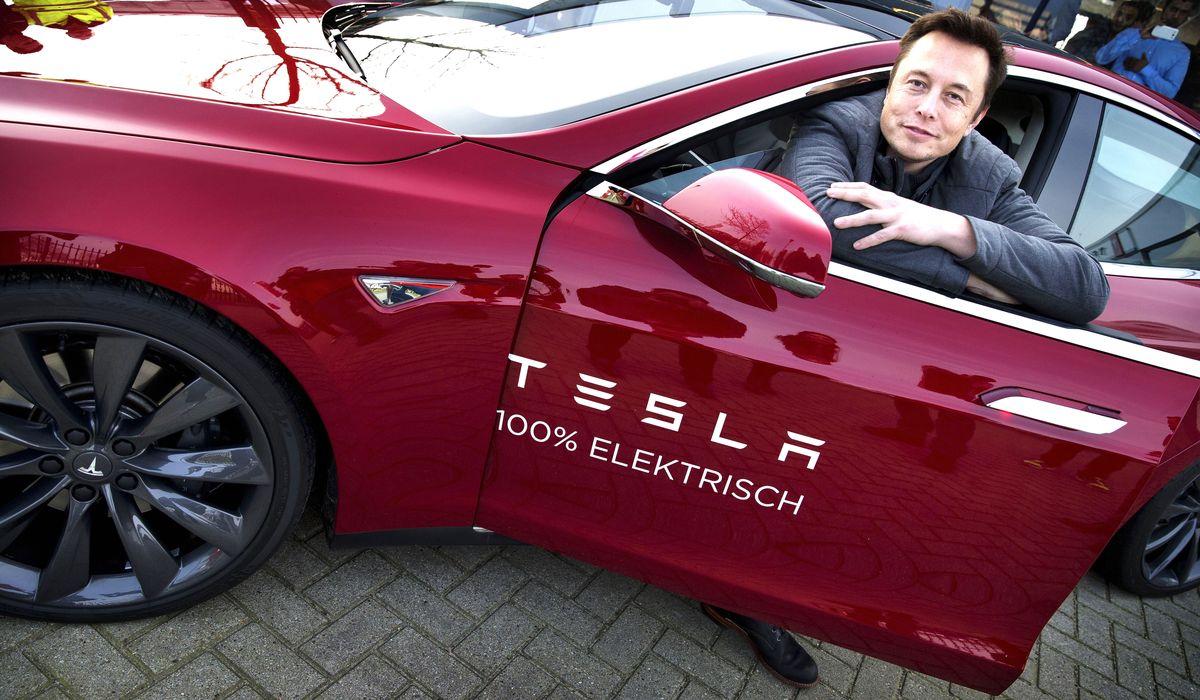

In defiance of Elon Musk, Delaware has lost its golden status as Tesla and a series of major corporations stage a mass exodus. The undercurrents behind this shift are shaking the foundations of the global business world.

For decades, Delaware has held a near-mythical status in American corporate law. More than half of all publicly traded U.S. companies and over 60% of Fortune 500 corporations have chosen Delaware as their legal home. Its business-friendly legal framework, efficient courts, and reputation for stability made the tiny state a corporate haven. But that golden age may now be slipping away, triggered by a confrontation with none other than Elon Musk.

At the center of the storm lies a high-profile legal battle involving Tesla’s monumental $56 billion pay package for Musk, approved by shareholders in 2018. Earlier this year, a Delaware judge struck down the compensation plan, arguing that it was excessive and unfair to shareholders. For Musk, who has built his empire on audacity and defiance, the ruling was more than a legal setback—it was a declaration of war against his vision and leadership.

In response, Musk wasted no time announcing that Tesla would move its corporate domicile out of Delaware. Instead, the electric car giant would re-incorporate in Texas, where Musk has already shifted much of his personal and business operations. What seemed at first like a symbolic gesture quickly snowballed into something much larger: a corporate exodus.

Tesla’s move sent shockwaves through boardrooms across America. Several companies began reevaluating their reliance on Delaware, questioning whether the state’s once-predictable legal system had become an unpredictable liability. Soon, high-profile firms started following Tesla’s lead, relocating to states perceived as more favorable to executive authority and shareholder flexibility. Delaware, once the default choice, suddenly looked vulnerable.

The financial impact was immediate. Delaware collects hundreds of millions of dollars annually in franchise taxes and incorporation fees. Losing even a fraction of its corporate clients could dent state revenues and undermine its long-cultivated reputation as the gold standard of corporate law. More importantly, the symbolic blow is far greater: if Delaware is no longer the unquestioned leader, the very foundations of America’s corporate landscape could shift.

But beneath the surface, a deeper power struggle is unfolding. Musk’s defiance is not just about protecting his paycheck—it is about reshaping the balance of power between executives, shareholders, and the courts. For decades, Delaware’s Chancery Court has prided itself on acting as the referee in corporate disputes, ensuring that no individual, no matter how powerful, could bend the rules too far. By openly rejecting its authority, Musk is testing whether superstar CEOs can rewrite the rules of corporate governance to suit their own ambitions.

This is why the business world is watching so closely. If Delaware loses its grip, the door opens for other states—such as Texas, Nevada, or even emerging tech hubs—to compete for corporate dominance. States may begin tailoring their laws to attract companies willing to pay for legal flexibility, triggering a race to the bottom—or a new era of corporate independence, depending on one’s perspective.

Critics warn that Musk’s victory could embolden other executives to push for unprecedented levels of control, potentially eroding shareholder protections. Supporters, however, see it as a necessary correction, freeing businesses from what they view as outdated legal constraints. Either way, the implications extend far beyond Delaware’s borders. This is no longer a local skirmish—it is a global business battle.

Elon Musk has always thrived on disruption, whether in space exploration, electric vehicles, or artificial intelligence. Now, he has turned his sights on something even more entrenched: the very architecture of corporate America. Delaware’s loss may be just the beginning.

The question rattling investors and policymakers alike is simple: if Musk can break Delaware’s dominance, who—or what—will be next to fall?